[ad_1]

Delaying Reforms Would Drive Abrupt Adjustments to Advantages

Printed: 2023-04-02

Creator: The Brotherly love Coalition | Touch: concordcoalition.org

Peer-Reviewed E-newsletter: N/A

Comparable Papers: Newest Pieces | Whole Record

On This Web page: Abstract | Defining U.S. Social Safety Consider Fund | Major Article | About/Creator

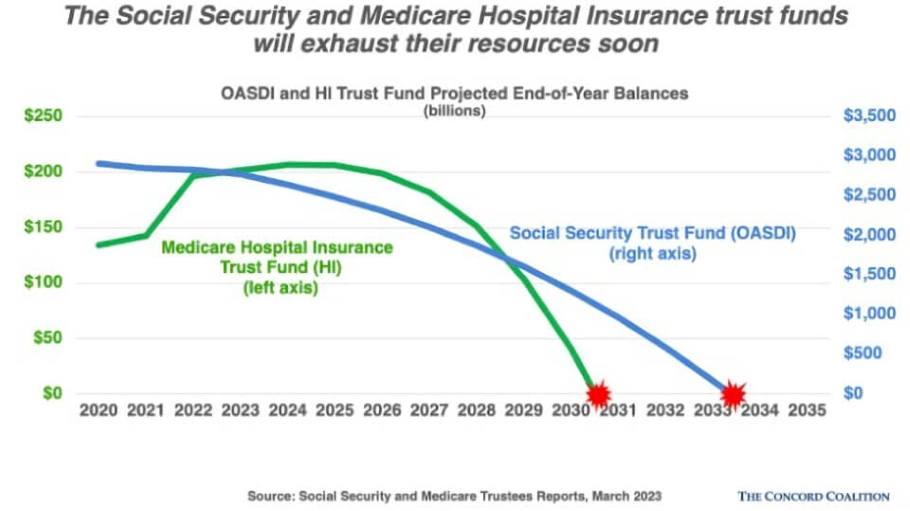

Synopsis: Reviews from Social Safety and Medicare trustees exhibit pressing want for motion to keep away from critical receive advantages cuts by means of 2034 for mixed retirement and incapacity techniques. The trustees warnings are the entire extra pressing since the country isn’t able of present or projected fiscal energy. Delaying reforms would pressure abrupt adjustments to advantages or an enormous infusion of basic revenues.

ads

Definition

- U.S. Social Safety Consider Fund

-

The Federal Outdated-Age and Survivors Insurance coverage Consider Fund and Federal Incapacity Insurance coverage Consider Fund (jointly, the Social Safety Consider Fund or Consider Price range) are believe finances that supply for cost of Social Safety (Outdated-Age, Survivors, and Incapacity Insurance coverage; OASDI) advantages administered by means of america Social Safety Management. The “Social Safety Consider Fund” incorporates two separate finances that cling federal govt debt duties associated with what are historically regarded as Social Safety advantages.

Major Digest

The Brotherly love Coalition mentioned as of late that this yr’s experiences from the Social Safety and Medicare trustees exhibit an pressing want for motion to keep away from critical receive advantages cuts by means of 2034 for Social Safety’s mixed retirement and incapacity techniques, and by means of 2031 for Medicare Section A (Sanatorium Insurance coverage).

Newest Comparable Publications:

“Doing not anything to make stronger the monetary outlook of Social Safety and Medicare isn’t ‘status up for seniors.’ It’s political cowardice and monetary malfeasance,” mentioned Brotherly love Coalition government director Robert L. Bixby.

“Those two techniques are tremendously vital for tens of millions of American households who depend on them for present or long run retirement source of revenue, incapacity advantages, and healthcare wishes. Below present legislation, then again, the one factor somebody can depend on is the knowledge that Social Safety and Medicare face unexpected cuts if Congress and the president fail to behave. It’s deeply disappointing that lawmakers of each events robotically forget about the trustees’ warnings. With insolvency shifting nearer, they must make it a concern this yr to search out answers which can be each fiscally and generationally accountable,” Bixby mentioned.

(Persevered…)

As detailed within the experiences, each techniques give a contribution to regularly emerging price range deficits whilst on the similar time neither program will pay the entire quantity of scheduled advantages beneath present legislation. Ignoring the warnings in those experiences will depart the general public unprepared for adjustments that should inevitably be made to place those essential techniques on a sustainable trajectory.

Bixby added:

“The trustees’ warnings are the entire extra pressing since the country isn’t able of present or projected fiscal energy. Delaying reforms would pressure abrupt adjustments to advantages or an enormous infusion of basic revenues. Both consequence would exaggerate generational inequalities.”

Let’s say the magnitude of the problem, the Social Safety trustees estimate that one among 3 issues should occur to stay the retirement program solvent over the following 75 years:

- (1) devoted revenues must build up by means of an quantity equivalent to a right away and everlasting payroll tax build up of three.44 proportion issues – from 12.4 p.c to fifteen.84 p.c, a right away 27.7 p.c build up.

- (2) scheduled advantages would need to be in an instant and completely diminished, for all present and long run beneficiaries, by means of 21.3 p.c, or (3) a mix of the 2.

The trustees additional notice that:

“If movements are deferred for a number of years, the adjustments important to deal with Social Safety solvency thru 2097 turn out to be focused on fewer years and less generations”

As a budgetary topic, it’s also vital to notice that Social Safety and Medicare don’t “pay for themselves.” The trustees’ experiences verify that Social Safety and Medicare Section A will revel in rising money deficits someday as they pay out greater than they obtain from their devoted assets.

Common federal revenues additionally enhance Medicare Section B, which gives quite a lot of scientific products and services, and Medicare Section D, which is helping pay for prescribed drugs. Through design, the premiums that older American citizens pay for those components of Medicare duvet most effective about 25 p.c in their prices. Consistent with the trustees’ record, Social Safety and Medicare had a internet draw at the price range of $457 billion in 2022. This consisted of $83 billion for Social Safety and $374 billion for Medicare.

The Brotherly love Coalition additionally lamented that for the 8th yr in a row, the general public trustee positions had been left vacant.

“It is a very severe omission,” Bixby mentioned. “We urge President Biden and Congress to agree on two credible applicants to fill those a very powerful positions in time for them to have a significant position in getting ready the 2024 record.”

Attribution/Supply(s):

This quality-reviewed article in relation to our U.S. Social Safety segment used to be decided on for publishing by means of the editors of Disabled Global because of its most likely hobby to our incapacity group readers. Even though the content material will have been edited for taste, readability, or period, the item “Serious Cuts Imaginable Through 2034 for Retirement and Incapacity Advantages” used to be in the beginning written by means of The Brotherly love Coalition, and revealed by means of Disabled-Global.com on 2023-04-02. Must you require additional knowledge or explanation, The Brotherly love Coalition may also be contacted at concordcoalition.org. Disabled Global makes no warranties or representations in connection therewith.

ads

Disabled Global is an impartial incapacity group established in 2004 to offer incapacity information and knowledge to other people with disabilities, seniors, their circle of relatives and/or carers. See our homepage for informative information, opinions, sports activities, tales and how-tos. You’ll additionally hook up with us on Twitter and Fb or be informed extra on our about us web page.

Permalink:

<a href=”https://www.disabled-world.com/incapacity/social-security/u.s.a./2034-trust-funds.php”>Serious Cuts Imaginable Through 2034 for Retirement and Incapacity Advantages</a>

Cite This Web page (APA):

The Brotherly love Coalition. (2023, April 2). Serious Cuts Imaginable Through 2034 for Retirement and Incapacity Advantages. Disabled Global. Retrieved June 27, 2023 from www.disabled-world.com/incapacity/social-security/u.s.a./2034-trust-funds.php

Disabled Global supplies basic knowledge most effective. The fabrics offered are by no means intended to exchange for pro hospital therapy by means of a certified practitioner, nor must they be construed as such. Monetary enhance is derived from ads or referral techniques, the place indicated. Any third birthday party providing or promoting does no longer represent an endorsement.

[ad_2]